News

The latest news from our group.

02.26.2026

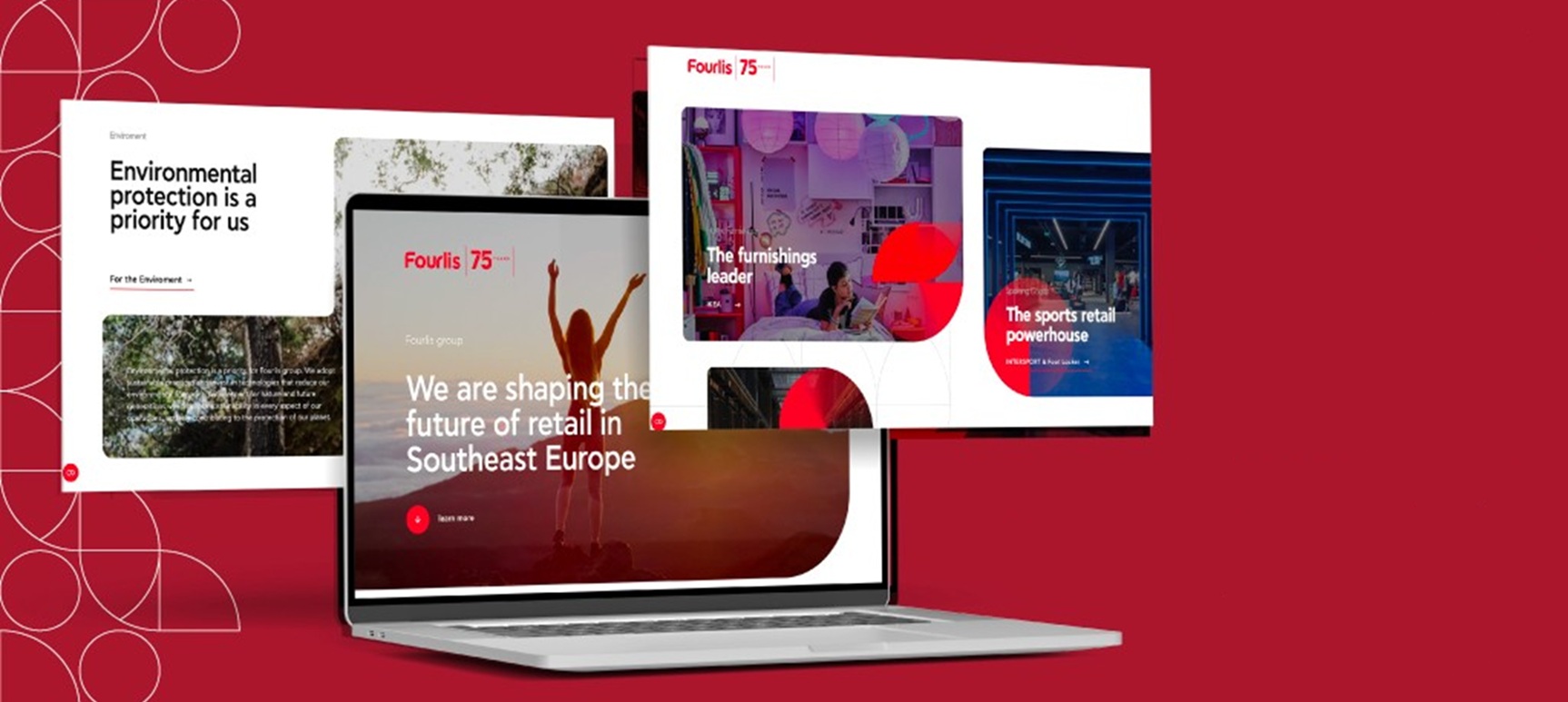

BRONZE Award for the new corporate website of Fourlis Group at the e-volution Awards 2026

A comprehensive corporate redesign built on strategic information architecture and performance-driven digital infrastructure.

02.09.2026

Double distinction for Fourlis Group at the HRIMA Business Awards 2025

Recognition of the Group’s strategy and financial performance for 2025.

01.29.2026

Vassilis Fourlis recognized among the 100 Most Influential Greeks for 2025

Vassilis Fourlis, Chairman of Fourlis Group, is listed among the 100 Most Influential Greeks for 2025 in the Mononews100 list by mononews.

12.10.2025

Fourlis Group – 75 Years: Writing the next chapter

This year, Fourlis Group marks 75 years of operation, a milestone that reflects a steady path of growth and entrepreneurial continuity.

09.15.2025

Sustainable Development and Corporate Social Responsibility Report 2024

Environmental footprint and social responsibility at the forefront.

09.04.2025

Fourlis group: New, modern corporate website

With its new website, Fourlis group highlights its international presence and showcases its commitment to sustainability and human-centric values.